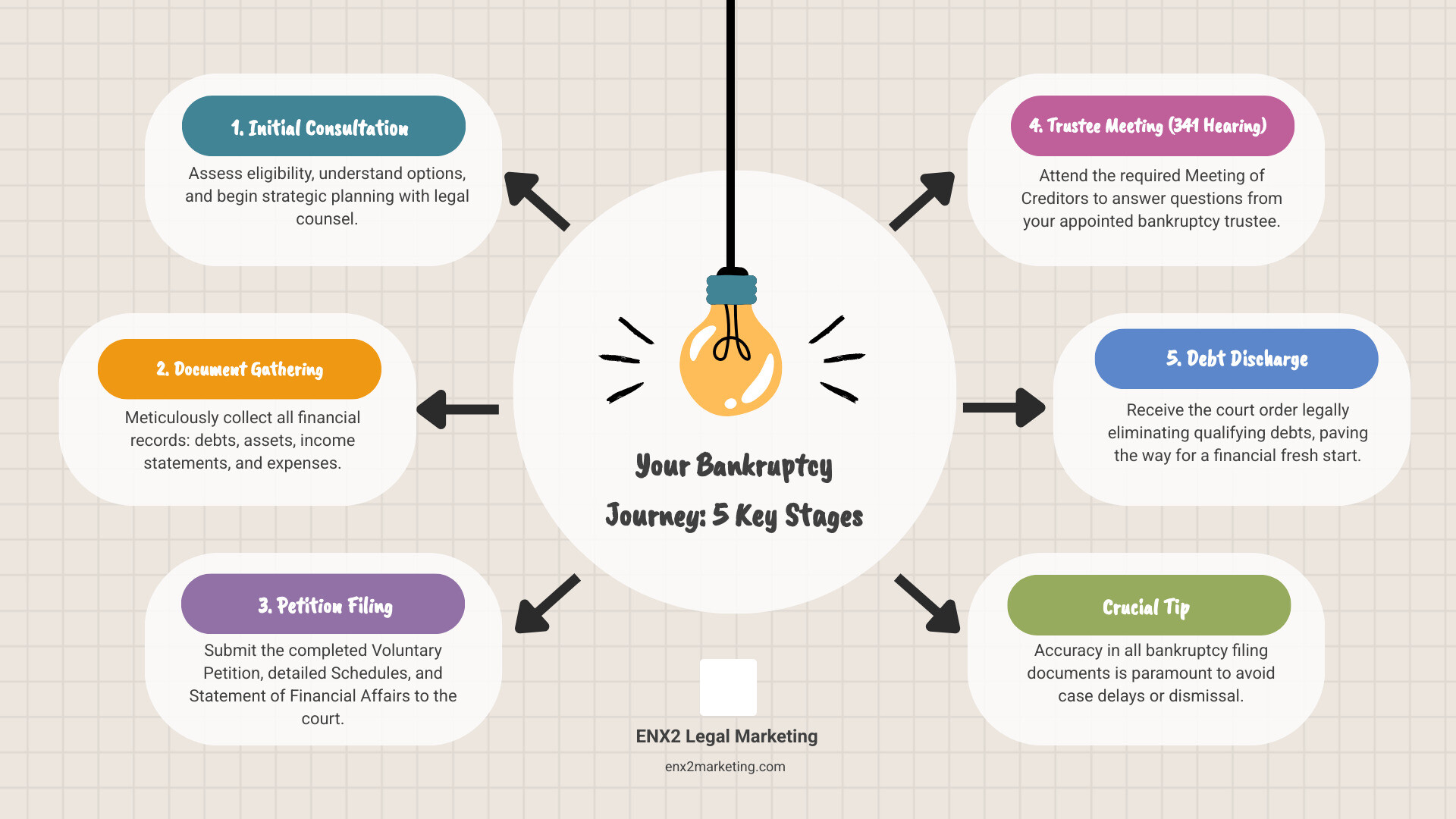

Your Roadmap to a Fresh Start

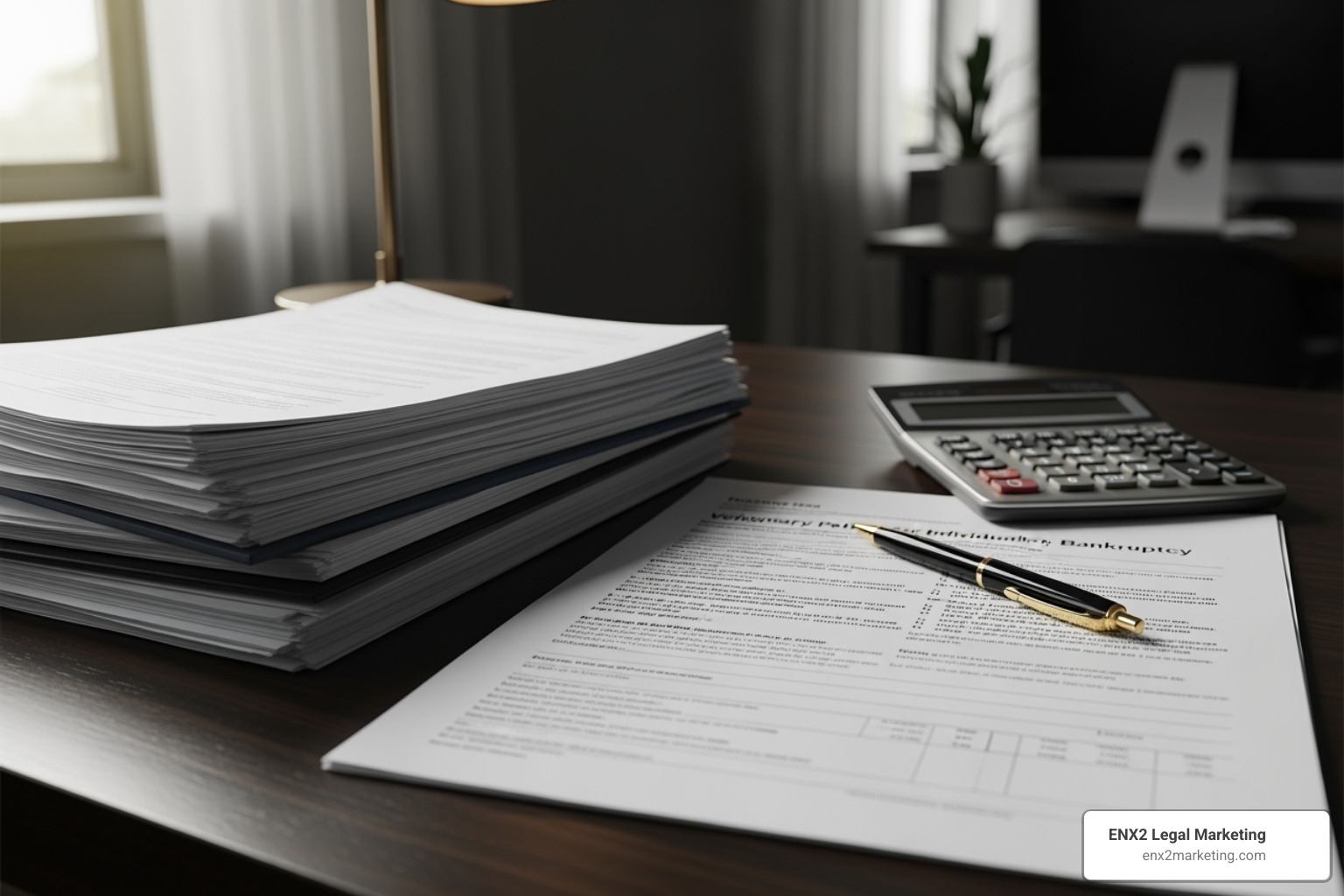

Bankruptcy filing documents are the legal papers required to start your bankruptcy case and obtain debt relief. This paperwork creates a complete financial snapshot for the court, including your petition to start the case (Form 101 or 201), financial schedules listing all assets and debts (Schedules A/B, D, E/F), income and expense statements (Schedules I & J), and a summary of recent financial history (Statement of Financial Affairs). You’ll also need supporting evidence like pay stubs, tax returns, and a credit counseling certificate.

Filing for bankruptcy can feel overwhelming, but preparing these documents correctly is crucial. As legal experts often note, accuracy is paramount because errors can lead to delays or dismissal, and intentionally false information constitutes bankruptcy fraud—a serious crime with severe penalties. The key is understanding what you need and how to complete it accurately.

I’m Nicole Farber, and through my work with ENX2 Legal Marketing, I’ve helped countless bankruptcy attorneys guide their clients through the complex world of bankruptcy filing documents. My experience has given me deep insight into the documentation challenges people face when seeking a fresh start.

A Step-by-Step Guide to Your Bankruptcy Filing Documents

Preparing your bankruptcy filing documents is like creating a complete financial story for the court. Breaking it down step-by-step makes the process manageable.

The Petition and Initial Forms: Opening the Door

Your journey begins with the voluntary petition, a crucial document that officially opens your case. Filing it triggers the automatic stay, which immediately stops most creditors from trying to collect from you.

Individuals use Official Form 101, while businesses use Official Form 201. These forms ask for basic information: your name, address, and the bankruptcy chapter you’re filing under (Chapter 7 for liquidation or Chapter 13 for a payment plan). You’ll provide estimates of your assets and debts and disclose any prior bankruptcy filings. Once signed and filed, the automatic stay provides immediate legal protection from wage garnishments and foreclosure, giving you breathing room. You can find the official forms on the U.S. Courts website. For attorneys, explaining these initial steps is key to effective Bankruptcy Attorney Marketing.

Financial Schedules: A Complete Picture of Your Finances

After the petition, you must paint a complete financial picture with a series of detailed schedules. Honesty and thoroughness are critical, as the trustee will review these documents meticulously.

- Schedule A/B (Property): This is a comprehensive inventory of everything you own. It includes real estate (your home), vehicles, bank accounts, retirement funds (like 401(k)s and IRAs), household goods, electronics, jewelry, and any potential claims you have against others (like a personal injury lawsuit). You must provide a reasonable current market value for each item, not what you paid for it. This is also where you list any property you can protect using bankruptcy exemptions.

- Schedule D (Secured Creditors): This schedule details debts tied to specific property, which acts as collateral. Common examples include a mortgage on your house or a loan on your car. If you stop paying, the creditor can repossess the property.

- Schedule E/F (Unsecured Creditors): This is often the longest schedule, covering all debts not backed by collateral. It’s divided into two parts: priority and non-priority debts. Priority unsecured debts are serious obligations that are typically not dischargeable, such as recent tax debts and domestic support obligations (alimony or child support). General unsecured debts include credit card balances, medical bills, personal loans, and utility bills.

- Schedule G (Executory Contracts and Unexpired Leases): This is for ongoing agreements where both parties still have obligations. Common examples include a residential lease, a car lease, or a cell phone contract. You must state whether you intend to “assume” (keep) or “reject” (end) each contract.

- Schedule H (Your Codebtors): Here, you must list anyone else who is legally responsible for any of your debts, such as a co-signer on a loan or a joint credit card holder. Filing for bankruptcy typically does not protect your co-debtors from creditors.

Missing assets or creditors can cause significant problems, so take your time. For law firms, clarifying this process is a core part of Digital Marketing for Bankruptcy Lawyers.

Your Statement of Financial Affairs and Income Statements

Beyond knowing what you own and owe, the court needs to understand your recent financial history and current cash flow. This is done through the Statement of Financial Affairs (SOFA) and your income and expense statements.

The SOFA asks about your income sources over the past two years, recent payments to creditors, property you’ve sold or transferred, and any business dealings or lawsuits. Schedule I details your current monthly income from all sources, while Schedule J breaks down your necessary monthly living expenses. Together, these forms determine your disposable income, a key figure for the Means Test. This test helps decide if you qualify for Chapter 7 or should be in a Chapter 13 repayment plan. Accuracy here is essential, as these figures form the foundation for your case.

Gathering Your Supporting Evidence

To verify the information in your forms, you must provide supporting documents. Gathering these early will streamline the process. Key evidence includes:

- Income Verification: Pay stubs from the last six months and your most recent federal and state tax returns.

- Asset and Debt Proof: Bank statements, property deeds, vehicle titles, and loan documents.

- Credit History: A recent credit report from all three bureaus can help ensure you’ve listed every creditor.

- Required Certificate: You must file a credit counseling certificate from an approved agency, completed within 180 days before filing.

An attorney can provide a complete checklist, which is a key service that can be highlighted in a Bankruptcy Lawyer Website Design.

The Risks of Improper Bankruptcy Filing Documents

Getting your bankruptcy filing documents right is critical to protecting your fresh start. Mistakes can have severe consequences.

Incomplete or incorrect forms can lead to case dismissal, forcing you to start over without the protection of the automatic stay. Even minor errors cause filing delays. More seriously, significant omissions could result in the loss of discharge, meaning you would still owe your debts after completing the process. Because all forms are signed under penalty of perjury, intentionally providing false information is considered bankruptcy fraud—a federal crime with penalties including hefty fines and imprisonment. The importance of accuracy cannot be overstated. If you need help, resources like the American Bar Association can connect you with free legal help from the American Bar Association.

Finalizing Your Filing and Finding Expert Guidance

You’ve steered the maze of bankruptcy filing documents and gathered your paperwork. Now it’s time to submit everything and move toward your financial fresh start.

How to Submit Your Bankruptcy Filing Documents and What to Expect

How you submit your bankruptcy filing documents depends on whether you represent yourself or hire a professional. While you can file “pro se” (representing yourself), bankruptcy law is complex, and mistakes can derail your case. Most people wisely hire a bankruptcy attorney.

An attorney will handle the technical side of filing through the court’s CM/ECF (Case Management/Electronic Case Files) system, the standard online portal for submissions. They ensure everything is formatted correctly and submitted on time.

You will also need to pay a filing fee, which varies by bankruptcy chapter. Courts sometimes allow payment in installments or may grant a fee waiver if your income is below 150% of the poverty line.

Once your documents are accepted, a trustee is appointed to your case. You will then attend the Meeting of Creditors, also known as the “341 hearing.” Despite the name, this is usually a brief, straightforward meeting with your trustee (and attorney). You’ll answer questions under oath about your documents, assets, and debts. Creditors rarely attend unless there are unusual circumstances.

The process differs slightly for businesses. Individual filers use Official Form 101, while corporations and partnerships use Official Form 201, which involves more complex financial disclosures.

Your Path to Professional Guidance

Navigating bankruptcy filing documents doesn’t have to be a solo journey. The right legal professional can make the difference between a smooth process and a maze of complications.

At ENX2 Legal Marketing, we understand how crucial it is for people facing financial difficulties to connect with experienced bankruptcy attorneys. Through our specialized Bankruptcy Lawyer SEO services, we help legal professionals reach the individuals and families who need their expertise most.

When someone is drowning in debt, they deserve to find attorneys who understand the complexities of bankruptcy filing documents and can guide them with confidence and compassion. That’s what we help make possible.